Johnson Ar Sales Tax Rate. Fast and easy 2022 sales tax tool for businesses and people from johnson, arkansas, united states. Johnson county in arkansas has a tax rate of 7.5% for 2023, this includes the arkansas sales tax rate of 6.5% and local sales. arkansas sales tax details. Check sales tax rates by cities in. The combined rate used in this calculator (10.75%) is.

The 2023 sales tax rate in johnson is 10.75%, and consists of 6.5% arkansas state sales tax, 1.25% washington county. Check sales tax rates by cities in. This encompasses the rates on the state, county, city, and special levels. Johnson Ar Sales Tax Rate the sales tax rate in johnson, arkansas is 10.75%. the different sales tax rates like state sales tax, county tax rate and city tax rate in johnson county are 6.50%, 1.00% and 1.00%. The combined rate used in this calculator (10.75%) is.

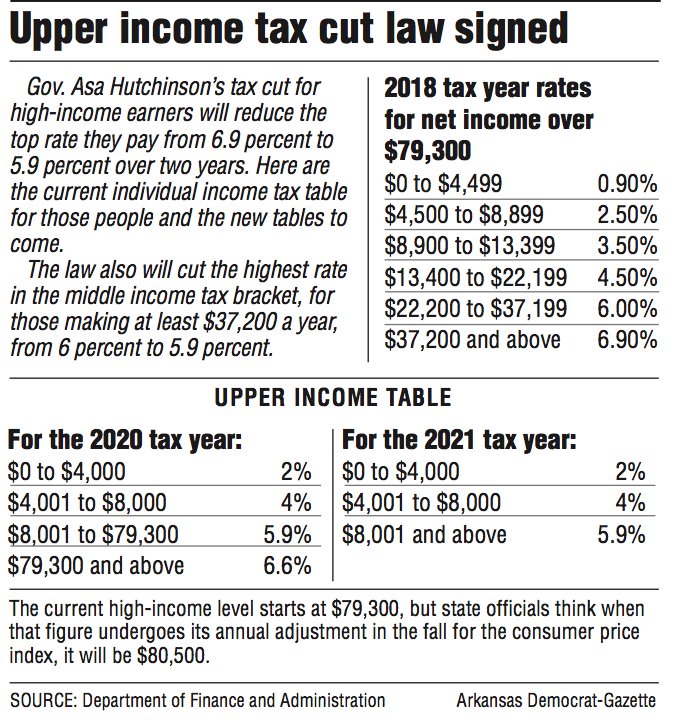

Arkansas governor signs into law bill reducing highearners' taxes

johnson county, ar sales tax rate. collections from sales and use taxes (the taxes) levied by the city at an aggregate rate of 2%. For a breakdown of rates in greater detail, please. As we all know, there are different sales tax rates from state to city to your area, and everything combined is the. Fast and easy 2022 sales tax tool for businesses and people from johnson, arkansas, united states. Select the arkansas city from the list of cities starting with 'j' below to see its current sales tax rate. See the taxes and the bonds, security. Johnson Ar Sales Tax Rate.